how to pay meal tax in mass

Individuals may report and. In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Barnacle Billy S At Perkins Cove Ogunquit Maine Vintage 1969 Postcard Ogunquit Cove Ogunquit Maine

Contact for Pay your personal income tax.

. If you plan on dining out during the states sales tax holiday later this month youll still have to pay the 625 percent Massachusetts meals tax. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. The state meals tax is 625 percent.

You can learn more by visiting the sales tax information website at wwwmassgov. Registering with the DOR to collect the sales tax on meals. Several examples of exceptions to this tax are.

Sales and use Sales tax on services Meals tax Meals tax Room occupancy excise Marijuana retail taxes. Toll-free in Massachusetts Call DOR. Eligible businesses will be able to delay without penalty sales meals and room occupancy taxes for March April and May until June 20.

This blog provides instructions on how to file and pay sales tax in Massachusetts using form ST-9. Tax Percentages for each town. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Businesses that paid less than. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Tax Department Call DOR Contact Tax Department at 617 887-6367.

To delete a payment i f the. The calculator will show you the total sales tax amount as well as the. Businesses that collected less than 150000 in regular sales and meals taxes in the year ending on Feb.

With the local option the meals tax rises to 7 percent. On a 100 restaurant check a customer would pay an extra 75 cents. Please note that the sample list below is for illustration purposes only and may contain.

29 will be eligible for tax relief state officials say. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. The payments must have a status of Submitted to be deleted.

The meals tax rate is 625. Massachusetts imposes taxes on income sales and use meals and room occupancy corporate income and non-income measures other business income estates and. After a few seconds you will be provided with a full.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. In Massachusetts there is a 625 sales tax on meals. Paying the full amount of tax due with the appropriate Massachusetts meals tax return on time and.

Boston Office 617-722-1570 District Office 508-237-7001. If you are just filing a use tax return you can use form ST-10. This page describes the taxability of.

The Massachusetts Sales Tax is administered by the Massachusetts Department of Revenue. Sales of meals to Harvard students are tax-exempt if. Advance payment requirements for.

In MA transactions subject to sales tax are assessed at a rate of 625. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Some jurisdictions in MA elected to assess a local tax.

Thus a 40 restaurant tab generates 280 in meals tax of which 30-cents goes to a city or town that. Payments that have a status of In Process or Completed cannot be deleted. Payments in MassTaxConnect can be deleted from the Submissions screen.

Massachusetts local sales tax on meals. The maximum tax that can be enacted on meals in. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor.

The local meals tax does not increase restaurant bills significantly. LicenseSuite is the fastest and easiest way to get your Massachusetts meals tax restaurant tax. Meals are also assessed at 625 but watch out.

Sales of meals to Harvard faculty and staff are taxable. How do I delete a payment. Meals are sold by.

Sales And Use Tax For Businesses Mass Gov

A Guide To Estate Taxes Mass Gov

How To Maximize Your Tax Return With Environmental And Eco Friendly Home Improvement Write Offs Umweltfreundliche Hauser Hausverschonerungsprojekte Leben

Massachusetts Sales Tax Rates By City County 2022

Professional Real Mass High Level Professional Mass Gainer

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Christina S Cafe Breakfast Brunch A Food Food

Massachusetts Sales Tax Small Business Guide Truic

Massachusetts Department Of Revenue Announces Updates To Relief For Certain Business Taxes Mass Gov

Pin On Life Skills Cooking Lessons

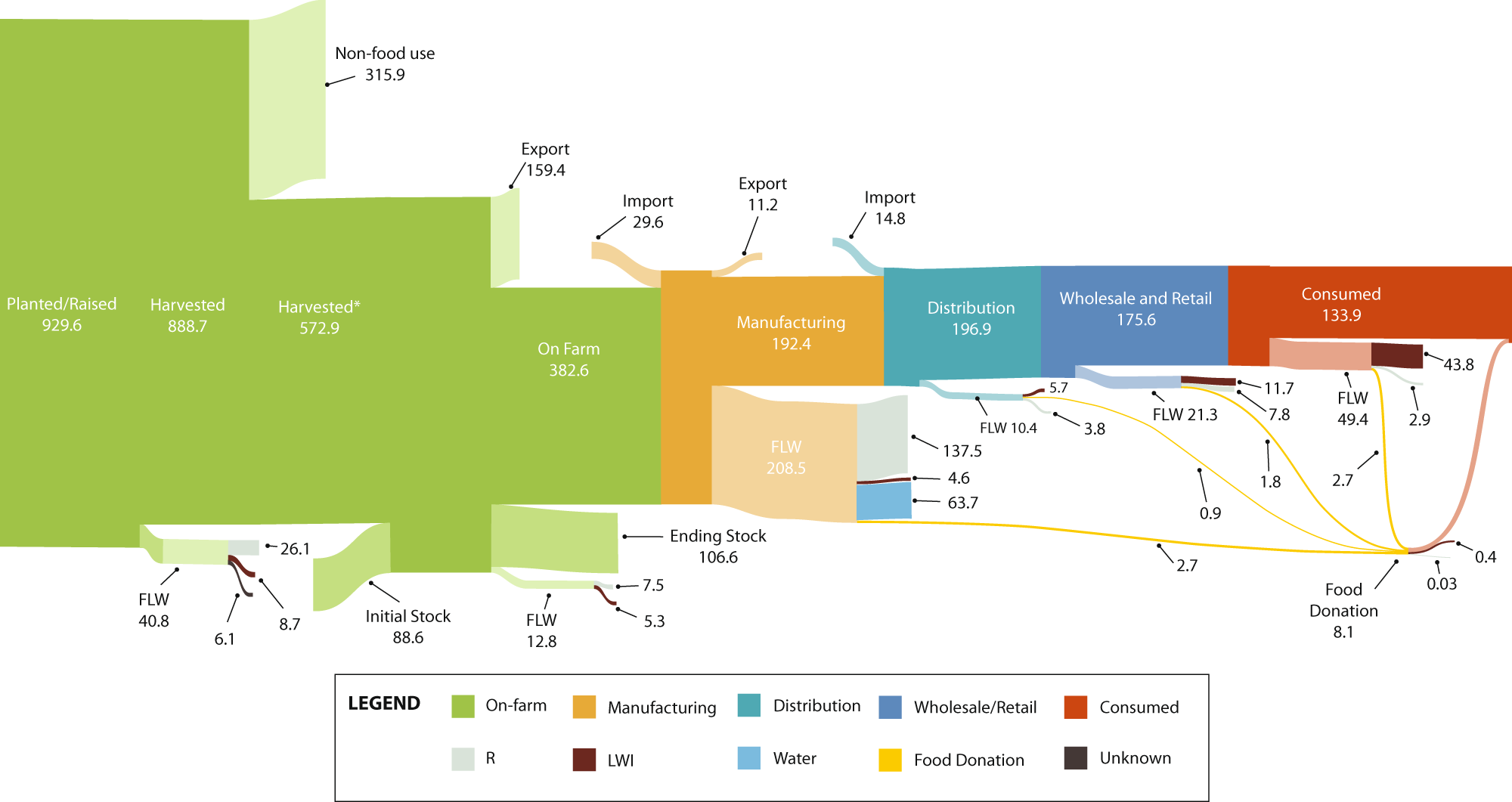

A Framework To Quantify Mass Flow And Assess Food Loss And Waste In The Us Food Supply Chain Communications Earth Environment

Here Are 7 Ways To Keep More Money In Your Pocket Or The Bank Smart Money Show Me The Money Financial Education

How To Add An Account Type To An Existing Location Youtube